Animal management is undergoing a global digital transformation — and RFID technology sits at the center of it. From livestock traceability to pet microchipping and wildlife monitoring, RFID tags have become the standard tool for ensuring identity, biosecurity, disease control, and supply-chain transparency.

As farms scale up, regulations tighten, and IoT ecosystems mature, the number of RFID tags used each year continues to rise. But what exactly is the annual consumption of RFID tags in animal management? And what trends will define the market in 2026?

1. Why RFID Is Now Essential in Animal Management

RFID enables digital identity and automated data capture across the entire animal lifecycle. Its mainstream adoption is driven by:

- Regulatory pressure for livestock traceability

- Biosecurity and disease-control requirements

- Smart farm automation and IoT integration

- Rapid growth of global pet ownership

- Wildlife conservation programs requiring long-term tracking

This growing dependency has made RFID a core infrastructure technology across agricultural, veterinary, and research sectors.

2. Major Applications of RFID in Animal Tracking

① Livestock Management (Largest Market Share)

Includes cattle, sheep, pigs, goats, camels, etc.

Common tag types: RFID ear tags (LF/UHF), bolus tags, injectable microchips

Use cases:

- Identity & birth registration

- Disease & vaccination records

- Feeding automation

- Supply-chain traceability

- Slaughterhouse compliance

② Companion Animals (Pets)

Common tag types: injectable glass-tube microchips

Use cases:

- Lost pet recovery

- Veterinary records

- Ownership verification

- City registration & licensing

③ Wildlife Research & Conservation

Common tag types: UHF/LF microchips, long-range specialized RFID tags

Use cases:

- Migration tracking

- Anti-poaching monitoring

- Population surveys

- Behavioral research

3. Annual Global Consumption: How Many RFID Animal Tags Are Used?

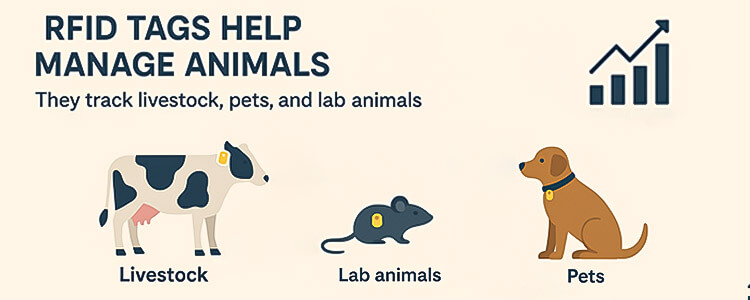

Based on livestock population data, pet-registration figures, industry reports, and growth forecasts, global RFID consumption can be estimated as follows:

Livestock RFID Tags (Ear Tags & Bolus Tags)

- Global livestock population (excluding poultry): ≈30 billion

- Average RFID adoption rate: 12–18% (varies by region)

- Annual replacement & loss rate: 5–10%

Estimated annual consumption: 650–800 million RFID livestock tags

Pet Microchips (Cats, Dogs, Others)

- Global new pets added yearly: ≈170–200 million

- RFID microchip adoption: 30–75% depending on region

Estimated annual consumption: 30–50 million microchips

Wildlife RFID Tags

Estimated annual consumption: 1–2 million tags

Total Estimated Annual RFID Consumption in Animal Management: 680 million – 850 million RFID tags per year

with livestock representing over 90% of total demand.

4. Key Drivers Behind RFID Growth

- Growth of cattle and sheep farming in developing markets

- Mandatory livestock ID laws across more countries

- Increase in global pet registration & microchipping programs

- Digital transformation in agriculture

- Growth of veterinary big-data platforms

- Rising interest in precision livestock farming (PLF)

- Increased investment in wildlife protection technology

5. 2026 Outlook: What Will Shape the RFID Animal-Tag Market Next?

1. Acceleration of Smart Farm Digitalization

IoT-connected farms will scale rapidly across Asia, South America, and Africa.

RFID tags will shift from “identity only” devices toward smart tags integrating sensors, enabling:

- Temperature tracking

- Rumination & movement monitoring

- Early disease detection

- Real-time yield prediction

2. Expansion of UHF Animal Tagging Systems

Historically, LF has dominated animal ID.

But by 2026, UHF ear tags will surge due to:

- Lower hardware cost

- Long reading range

- Batch reading for large herds

- Compatibility with automated sorting gates

3. Global Regulatory Tightening

More regions will join established programs like:

- EU Animal Traceability Regulations

- Australian NLIS

- U.S. RFID-based cattle identification (expanding by 2026)

- China’s agricultural digitalization roadmap

This means RFID adoption will not only rise — it will become unavoidable.

4. Growing Demand for Lab-Animal RFID

Biotech & pharmaceutical growth is pushing:

- Mouse/rat microchips

- Cage-level tracking

- Automated lab-animal identification systems

By 2026, the lab-animal RFID sector is expected to see double-digit annual growth.

5. Supply-Chain Optimization and Lower Costs

Chip manufacturing, antenna production, and global material supply have become more efficient.

By 2026:

- RFID ear tags will be cheaper and more accessible

- ODM/OEM sourcing will become easier for brands

- Lead times will continue to shorten

6. What This Means for Businesses

If you are in the RFID industry, livestock supply chain, pet management, or animal research field, the trends above mean:

- Demand for RFID tags will continue to climb steadily through 2026

- Smart tags + cloud platforms will become core differentiators

- UHF animal tags will create new business opportunities

- Regulatory-driven adoption will bring long-term stability to the market

7. Recommended Products for 2026 (Natural Placement)

For businesses preparing for the next wave of RFID adoption, high-performance animal-tag products from CXJ RFID Factory provide scalable, industrial-grade solutions:

▶ RFID Animal Ear Tags (LF / UHF)

Ideal for cattle, sheep, pigs, goats

▶ RFID Microchips for Pets & Wildlife

ISO11784/11785 compliant

▶ Customizable RFID Animal-ID Solutions

OEM/ODM available for livestock & wildlife projects

RFID technology has become the foundation of global animal management — and demand is far from reaching its ceiling. With an estimated 680–850 million RFID animal tags consumed annually and strong growth expected in 2026, the sector is entering a phase of rapid expansion fueled by regulation, digitalization, and smarter farming ecosystems.

For RFID manufacturers, agricultural suppliers, and IoT solution providers, the next two years represent a significant opportunity to innovate, upgrade product lines, and expand globally.